Current Status and Outlook of Japanese LCCs~including Domestic Routes and International Long-haul Routes~

- Colloquium

- Aviation and Airport

The 133rd Transport Policy Colloquium

| Date / Time | Wed, Oct 02,2019 16:00~18:00 (Open 15:30) |

|---|---|

| Venue | Japan Transport and Tourism Research Institute (JTTRI) (Tokyo) |

| Theme | Current Status and Outlook of Japanese LCCs ~including Domestic Routes and International Long-haul Routes~ |

| Lecturer | Yasuo Hashimoto Visiting Research Fellow, Japan Transport and Tourism Research Institute (JTTRI) |

| Commentator | Shinya Hanaoka Professor, Department of Transdisciplinary Science and Engineering, Tokyo Institute of Technology, School of Environment and Society |

Event Summary

With the Japanese government’s policy to encourage the Low Cost Carrier (LCC) business, Japanese LCCs entered business at full scale in 2012.

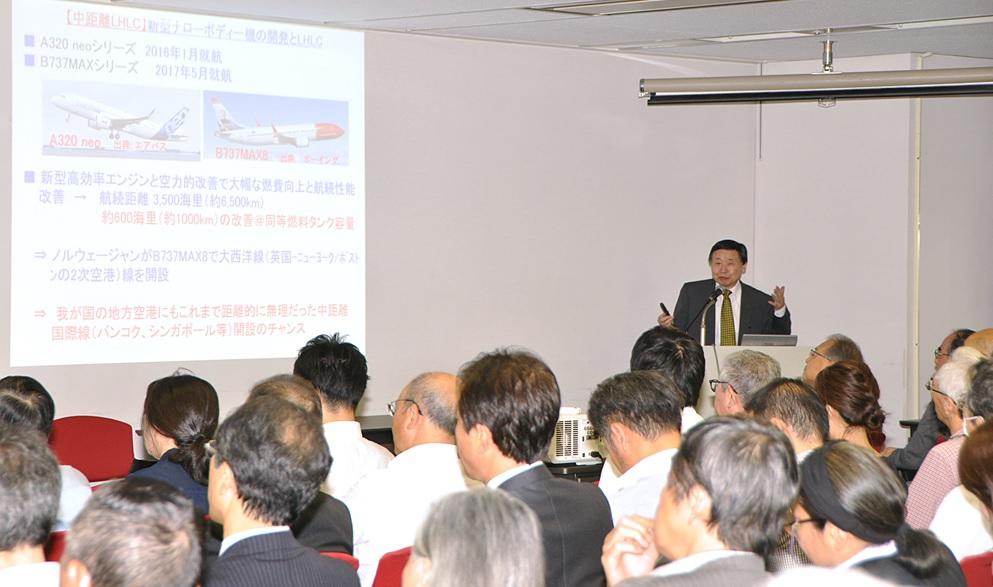

Their services on domestic and international routes have been gradually expanded. They are planning to launch middle and long-haul international flights in 2020, which has still been at a trial stage worldwide.

As to the domestic flight business, while the Japanese LCCs achieved a rapid growth of expansion, they have suffered poor performance since 2015 at 9-10% of passenger volume share, falling far short of 30-40% which is the passenger volume share of LCCs in US and Europe. Now they are facing the difficulty in achieving the target of 14% (in 2020) specified in the Japanese government’s “Basic Plan on Transport Policy.”

This colloquium provided an opportunity to deliberate the current status and outlook of Japanese LCCs and examined further possibility of taking any additional incentive measures, while it gave an analysis of factors in the low share of the Japanese LCCs in the domestic business as well as future prospects of the Japanese LCCs to advance to the middle and long-haul international flghts.

Program of the seminar is as the following

| Opening Remarks 1 |

Masafumi Shukuri |

|---|---|

| Opening Remarks 2 |

Hirotaka Yamauchi |

| Lecturer | |

| Commentator | |

| Question and Answer |

|

| Closing Remarks |

Yoshinobu Sato |

Outline of the seminar

Hashimoto, JTTRI visiting research fellow, gave an analysis on the Japanese LCCs’ share in domestic passenger volume, which remained at low level around 10% in the Tokyo metropolitan area, while 25.6% in the Osaka region and 19.8% in the Chubu region.

His study also showed the Japanese LCCs’ business impact to domestic passengers and the society.

(1) Achieved a V-shaped recovery, stimulating domestic air travel demand and expanded the demand, creating new demand.

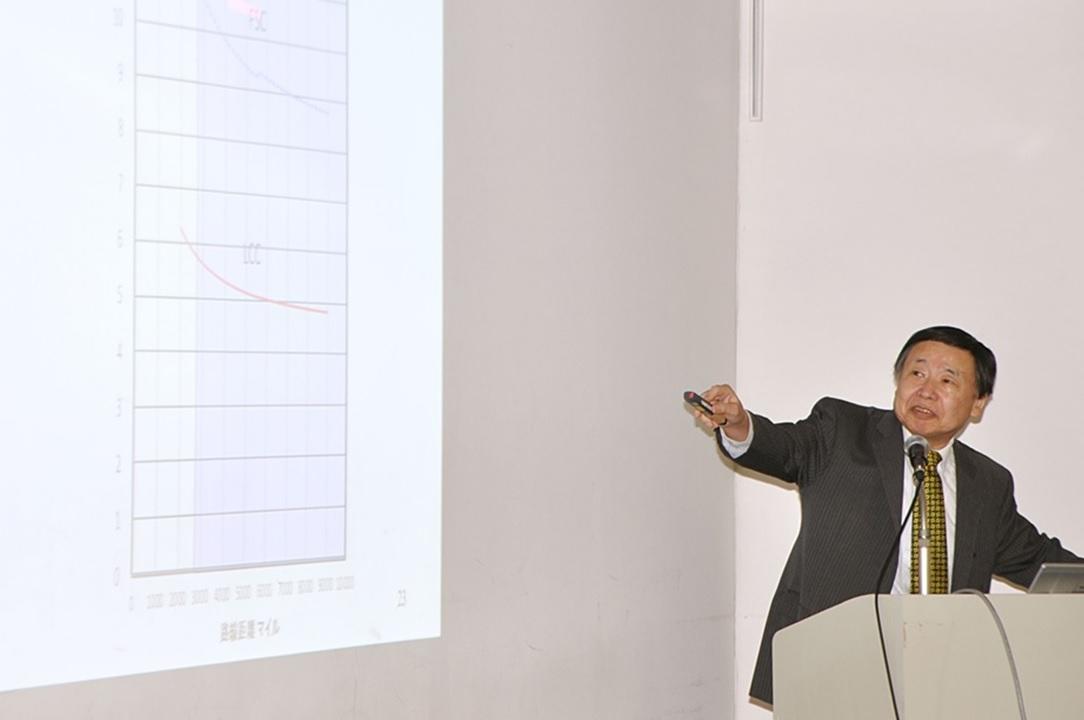

(2) A decrease in the FSC yield (revenue per passenger/km) came around 1yen, which developed a tendency to reduce airfares by 1 % on an annual basis.

(3) Promoted sound competition between the Sanyo Shinkansen and Kyushu Shinkansen. Some fares of the Shinkansen became cheaper than before. (e.g. discount ticket sales)

His proposal considered prospects of expansion of the Japanese LCCs’ domestic passenger share.

(1) Promoting utilization of LCCs, improving the function of Narita Airport such as expansion of the LCC terminal, the number of takeoffs and landings, and departure and arrival time.

(2) Increasing passenger volume (number of seats) by expansion of LCC business.

(3) Increasing the number of seats and the size of aircrafts.

Mr. Hanaoka, a commentator of this colloquium, pointed out the two important points when analyzing LCC domestic passengers: One is that the domestic air travel demand increase (in the routes not entered by an LCC) cannot be explained satisfactorily by the LCC’s entry alone. The other is that the competition among transport business operators especially between the metropolitan areas with a few airports such as Tokyo (Haneda/Narita Airport) and Osaka (Itami/Kansai/Kobe Airport) and the impact of Shinkansen cannot be ignored.

It was a successful colloquium with over 158 participants who took part in an active discussion in the Q& A session. They were from universities and other research organizations, the Ministry of Land, Infrastructure, Transport and Tourism, airlines, airport companies, other transportation companies, and consulting firms.